How Andrew Jackson Freed America from Central Bank Control—and Why It Matters Now

It’s hard to believe the United States government was ever debt-free. But it occurred once—in 1835—thanks to President Andrew Jackson. He was the first and only president to pay off the national debt completely.

One biographer says the former president viewed debt as a “moral failing,” a sort of “black magic.”

When he became president, Jackson was determined to rid the US of its national debt. After all, debt enslaves you to your creditors. Jackson knew that being debt-free was essential to independence. This outlook resonated with many Americans back then.

Considering that, Jackson attacked the institutions and powerful people who promoted and enabled the federal debt. This included the banking elites and the Second Bank of the United States, the country’s central bank at the time and precursor to today’s insidious Federal Reserve system.

While campaigning against the evils of national debt and central banking, Jackson miraculously survived an assassination attempt when an assassin’s two pistols both misfired. Shadowy interests tied to the central bank were almost certainly behind the effort.

However, Jackson survived and went on to “End the Fed” of his days. He successfully closed the central bank—and the powerful interests behind it—and shut down the Second Bank of the United States. He also repaid the federal debt in full, which was no easy task.

Jackson couldn’t squeeze the American people with a federal income tax to repay the debt. It didn’t exist at the time and would have been unconstitutional.

He also couldn’t simply print currency to pay off the debt. Perpetuating such an insane fraud—which the Fed does on a massive scale today—likely never entered his consciousness.

Instead, Jackson had to rely on tax revenue from other sources, mainly import tariffs and excise taxes, to pay down the debt. He also drastically cut federal spending and frequently vetoed spending bills.

Jackson’s determination worked. By January 1835, the US was debt-free for the first time.

Unfortunately, it didn’t last much more than a year. After that, the US would never again be debt-free—not even close.

Revenge of the Central Bankers

After Jackson succeeded in ending the Second Bank of the United States, anything associated with a central bank became deeply unpopular with the American public. So, central bank advocates tried a new branding strategy.

Rather than call their new central bank the “Third Bank of the United States,” they went for a vague and boring name. They called it “the Federal Reserve” and managed to hide it from the average person in plain sight. As a result, over 100 years since its founding, most Americans have no idea what the Federal Reserve is or what it actually does.

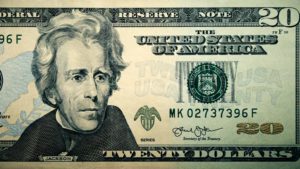

Ironically, Jackson’s face has been on the $20 “Federal Reserve Note” since 1928. So in a sense, this symbolic move is central banking advocates giving the middle finger to one of their most steadfast opponents.

After all, the Fed is really the “Third Bank of the United States.” No doubt, Jackson would have been disturbed at having his face on its fake confetti money.

In any case, most Americans today have no idea who Jackson is, what he did, or why he did it. To the extent he is ever mentioned, the media, academia, and the rest of the establishment unjustly besmirch him as—you guessed it—a “racist.”

That’s exactly what the Deep State—the permanently entrenched bureaucracy—wants. It doesn’t want the average citizen to understand why Jackson shut down the central bank and (temporarily) freed Americans from national debt bondage. Doing the same today would be a mortal threat to their power.

This is one of the reasons the establishment will try in the coming years to replace Jackson on the $20 bill with the more politically-correct Harriet Tubman, pushing Jackson further down the memory hole.

Trillions and Trillions

You often hear the media, politicians, and financial analysts casually toss around the word “trillion” without appreciating what it means. A trillion is a massive, almost unfathomable number.

The human brain has trouble understanding something so huge. So let me try to put it into perspective. Suppose you had a job that paid you $1 per second, or $3,600 per hour. That amounts to $86,400 per day and about $32 million per year.

With that job, it would take you 31.5 years to earn a billion dollars. With that job, it would take you over 31,688 YEARS to earn a trillion dollars. So that’s how enormous a trillion is.

When politicians carelessly spend and print money measured in the trillions, you are in dangerous territory. And that is precisely what the Federal Reserve and the central banking system has enabled the US government to do.

It took 146 years after Jackson fully paid off the debt in 1835—or until 1981—for the US government to rack up its first trillion in debt. The second trillion only took four years. After that, the next trillions came in increasingly shorter intervals.

Today, Congress has normalized multi-trillion dollar federal spending deficits. The US federal debt has gone parabolic and is scores of trillions.

If you earned $1 per second, it would take over 1,131,261 YEARS to pay off the current US federal debt. And that’s with the unrealistic assumption that it would stop growing.

The US federal government has the largest debt in the history of the world. And it’s continuing to grow at a rapid, unstoppable pace. The debt will keep piling up as the US government continues to pay for political promises. It’s virtually inevitable.

The federal debt also represents an outrageous crime inflicted on the next generation. They are the ones who will be stuck with this massive unpaid bill from today’s spending, and it will turn them into indentured serfs.

It’s doubtful Congress considers this even for a second. They are always eager to send billions to faraway foreign lands or the latest boondoggle.

Of course, this is not a groundbreaking revelation. People like Ron Paul have warned Americans about the dangers of the federal debt for a long time. It’s just that nobody has heeded these warnings. And no one has taken serious political action to address the problem.

The interest expense on the federal debt is now larger than defense spending and is about to exceed Social Security to become the BIGGEST expenditure in the federal budget. And it won’t stop there.

In short, the US government is approaching the financial endgame and can no longer disguise its bankruptcy. If we step back and zoom out, the Big Picture is clear. We are likely on the cusp of a historic shift, and what’s coming next could transform everything.

Author: Nick Giambruno

yogaesoteric

November 11, 2024