Secretive International Banking Group may enforce Great Reset ‘Green’ Agenda on world

Adherence, or not, to green policies, could determine whether an individual or a business is allowed access to finances

The U.S. Federal Reserve has recently joined a little-known international conglomerate of central banks, all fundamentally committed to enforcing the “green,” eco-friendly dictates of the anti-life, global governance Paris agreement, in line with the Great Reset.

Such a move has raised alarming concerns about the influence which banks will exert in enforcing green policies as part of the World Economic Forum’s so-called Great Reset.

For instance, one of the goals of this all-powerful, world-banking conglomerate appears to be to decimate the entire fossil fuel industry and the many thousands of industries and millions of jobs related to it.

In September, LifeSiteNews co-founder Steve Jalsevac warned that COVID-19 is being used as a means to implement extreme, globalist policies to promote the green agenda. He noted the “shocking climate change connection to the Wuhan virus mitigation policies and that it is really about implementing the extreme Paris Climate Change Accord policies and UN Sustainable Development goals, the ‘Great Reset,’ and world depopulation goals.

Lockdowns have led to massive, man-made carbon dioxide and pollution drops. The globalists are forcing people to see what the world would look like if there were fewer people in the world, as though we will all be positively impressed with empty streets and highways, no cruise liners on the seas, and few aircraft in the skies. It is downright evil.”

In December 2020, the U.S. Federal Reserve Board announced that it had joined the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), which is an international group of “Central Banks and supervisors” with the purpose of transforming the global economy in alignment with green, sustainable policies.

Noting the move, the New York Times wrote that it was a welcome success for Democrats, who had been pushing for this, and described it as an “evolution” for the Federal Reserve in terms of paying much closer, and more public attention to “extreme weather events” and their potential “risk to the financial system.”

Reporting on the news, Breitbart observed how it was peculiar that the left, particularly the green movement, had greeted the Federal Reserve’s move with “applause,” given that historically the left had been “mostly hostile to big financial institutions, seeing them as pillars of Capital.”

The NGFS and its commitment to the Paris Climate Agreement

The almost unknown NGFS (Network for Greening the Financial System) was born at the Paris “One Planet Summit” in December 2017, with the aim of: “Strengthening the global response required to meet the goals of the Paris agreement and to enhance the role of the financial system to manage risks and to mobilize capital for green and low-carbon investments in the broader context of environmentally sustainable development.”

Its focus is the role which “climate change” will have upon the economy, the financial system, and banking. However, the group is not limited to forming policies for internal discussion, but also seeks to implement them outside its members. “The Network defines and promotes best practices to be implemented within and outside of the Membership of the NGFS and conducts or commissions analytical work on green finance.”

Whilst the NGFS is an organization which has not moved into the public consciousness, it is by no means inconsequential. In its three years of existence, it has gone from starting with only eight members to having now grown to 83 members, with an additional 13 banks listed as “observers.”

The member banks are some of the most influential in the world, with national and international names such as: “Bank of Canada; Bank of England; Banque de France; Dubai Financial Services Authority; European Central Bank; Japan FSA; People’s Bank of China; Swiss National Bank; U.S. Federal Reserve.”

Meanwhile, amongst the observer banks are names such as the “Bank for International Settlement; European Investment Bank; International Monetary Fund; World Bank and the International Finance Corporation.”

“Adhering” to the NGFS entails “a political commitment from an institution and also implies the will and capacity to actively contribute to the work.”

The group’s first comprehensive report from 2019 offers an example of what sort of work the NGFS is actually involved in. It plans to “globally cooperate with policy makers, the financial sector, academia and other stakeholders to distil best practices in addressing climate-related risks.”

“Climate change” and “climate-related risks are a source of financial risk,” the group declared. “We need to take action and we cannot and will not do this alone. We will globally cooperate with policy makers, the financial sector, academia and other stakeholders to distil best practices in addressing climate-related risks.”

As part of its action, the NGFS released six recommendations to banks and policymakers, based upon the 2015 Paris Agreement, outlining the path to a “low-carbon economy,” and calling ultimately for “‘net zero’ to prevent further climate change.”

The most well-known goals of the 2015 Paris Climate Agreement, which the NGFS holds as its operating standard, are to “limit global warming,” reduce the effect of “climate change,” and to enact policies which further this goal throughout the world.

The third aim is less known, however, and pertains directly to the financial element of the agreement, ensuring that the future of global finance is directly connected to the various climate change efforts laid down in the Paris agreement. It reads: “Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.” This aim provides the basis for the NGFS’s policies, which link finance to the implementation of the green agenda of the Paris Agreement.

Even the NGFS’s self-description, of sharing “best practices” and contributing to the “development of environment and climate risk management in the financial sector to mobilize mainstream finance to support the transition toward a sustainable economy,” closely mirrors the text of the Paris Agreement, as found in Article 7: 7 (a).

Linked to the Great Reset Green Agenda

Klaus Schwab of the World Economic Forum, Prince William, and David Attenborough

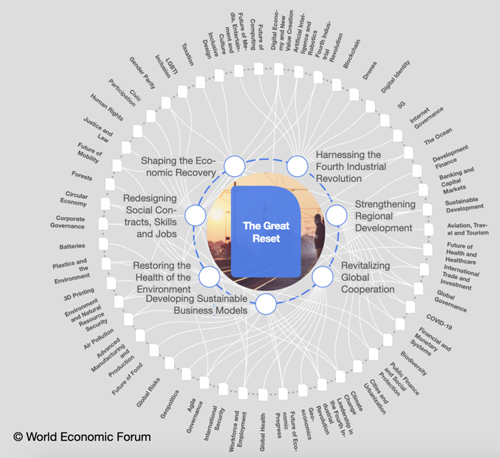

All of the NGFS’s green policies and plans align closely with the World Economic Forum’s (WEF) globalist Great Reset. The WEF, founded and led by Klaus Schwab, has used the COVID-19 virus as an opportunity to present its plan of a Great Reset of complete societal alteration and structural shifts.

In June 2020 Schwab wrote that the coronavirus outbreak was exacerbating “the climate and social crises,” and that as a result the world would become “less sustainable, less equal, and more fragile.”

The U.K.’s Prince Charles, a major proponent of the Great Reset, echoed Schwab by saying that COVID was “an opportunity we’ve never had before and may never have again.” Considering the planet almost as a person, he said: “Our activities have been damaging her immune system.”

Schwab’s envisaged Reset is underpinned by a focus on a green financial agenda, as he mentions the “withdrawal of fossil-fuel subsidies,” and a new financial system based on “investments” which advance “equality and sustainability,” and the building of a “‘green’ urban infrastructure.”

Businesses would be provided with so-called “incentives” to improve their operation in line with “environmental, social, and governance metrics.”

To this end, the WEF partners with the United Nations (U.N.) in effecting the UN’s 2030 Sustainable Development Goals (SDG), which are pro-abortion and heavily promoting of a green agenda “to combat climate change.”

Schwab has stated that the SDGs are “essential for the future of humanity,” having previously served for five years on U.N. committees for sustainable development planning.

In order to widely and properly effect the green goals of the U.N. and the WEF, the Great Reset must necessarily be underpinned by a fundamental shift of the financial system in line with green policies.

As the International Monetary Fund’s managing director, Kristalina Georgieva, said at the WEF Great Reset conference in June 2020: “We see a very massive injection of fiscal stimulus[.] … But it is paramount that this should lead to a greener, fairer, smarter world in the future.”

A few months later she repeated her call for financial change linked to climate change policies, saying “macroeconomic policies are central to the fight against climate change.” In fact, in a video from November 2020, the WEF pointed once again to the Paris Agreement, as it promoted “green finance” to “help save the planet.”

Furthermore, an article published on the WEF website that same month outlined how pivotal green-oriented finance was in bringing about the Great Reset. “Strategic investments in ESG [environmental, social and governance] must represent a fundamental tenet of this framework.

In building this ‘reset’, a whole range of stakeholders from investors, corporates, governments, financial institutions and consumers must align to create an ecosystem through which we invest in a cleaner, greener future.”

It was in light of all this that Breitbart’s report noted, “NGFS is the global fusion of Big Green and Big Money, also known as Woke Capital… it’s that same Woke Capital that’s been leading the push for ‘The Great Reset’.”

Lockdowns held as a benefit for the world in Great Reset

In understanding the primacy of the Green Agenda and Green Finance in the Great Reset, it is important to note the manner in which Schwab has welcomed the various restrictions seen in the last year, as a benefit for the planet.

As lockdowns shut down countries across the world and decimated economies, Schwab wrote in Time in October 2020, pointing to the benefit which came as a result of such unprecedented societal disruption: “the drop in greenhouse-gas emissions, which brought slight, temporary relief to the planet’s atmosphere.” However, in his recent book, entitled COVID-19: The Great Reset, Schwab wrote that there was still much progress to be made in terms of reducing “carbon emissions.”

The 8% estimated reduction in carbon emission which he cited, was termed “rather disappointing,” and he called for a greater, fundamental change. If such a focus on green polices was not adopted, then “the COVID-19 crisis will have gone to waste as far as climate policies are concerned.”

“The COVID-19 crisis cannot go to waste and that now is the time to enact sustainable environmental policies,” Schwab declared. “The climate risk is unfolding more slowly than the pandemic did, but it will have even more severe consequences.”

“Our consumption patterns changed dramatically during the lockdowns by forcing us to focus on the essential and giving us no choice but to adopt ‘greener living’.”

Green Agenda adherence will determine financial future

As part of its series of Great Reset articles, Time published a piece describing a futuristic vision of the year 2023, entirely built around the concept of a huge, financial shift in line with green policies and so-called climate change. It was written by Mariana Mazzucato, a member of the U.N. Committee for Development Policy, and a former member of the WEF Global Agenda Council on the Economics of Innovation. Mazzucato described a global population which realized the “need for governments to form a coordinated response to climate change and direct global fiscal stimulus in support of a green economy.” The level of societal change which she describes, in order to align the financial system with green ideas, is nothing short of a paradigm shift. She mentions a “green economy” based on “entire supply chains and every stage of technological development,” whilst “at regional, national and supranational levels, ambitious Green New Deal programs rose to the occasion.” Repeating what is a common theme in Great Reset literature, Mazzucato mentioned how governments would coax, or perhaps tell people how to conform to the green economy: “Governments used procurement, grants and loans to stimulate as much innovation as possible.”

In reality, the plan appears to dramatically limit finances to only those who totally support the radical green agenda. Adherence, or not, to green policies, could determine whether an individual or a business is allowed access to finances, according the Great Reset architect, Klaus Schwab: “Governments led by enlightened leaders will make their stimulus packages conditional upon green commitments. They will, for example, provide more generous financial conditions for companies with low-carbon business models.”

A recent essay on the WEF website called on “Governments” and “regulators” to use “hard dollars and soft power” in order to “mandate and incentivize” the “sustainable investments” necessary for a “cleaner, greener future.”

Another repeated Schwab’s theme, mentioning that “Banks will play a critical role in supporting the transition to net zero carbon emissions.” “Companies, and investors doing business with them, will have to respond,” to the emphasis on sustainability, the article proclaimed. “These commitments create new opportunities for climate leaders and increase the pressure on laggards.”

“To stop the climate crisis from further unfolding and end our dependence on fossil fuels, banks must stop financing the fossil fuel industry,” wrote an international banking campaign group called BankTrack.

Are Banks to become de facto enforcers of the Great Reset?

The WEF article, calling for an increase in pressure on “laggards” was written by Barry O’Byrne, Chief Executive Officer of Global Commercial Banking, HSBC. It was that same bank, HSBC, which recently announced it plans to take the unprecedented measure of cancelling customers’ accounts, if they entered the bank without a face mask.

A number of other financial “cancellations” have taken place recently, notably aimed at those opposing COVID lockdowns, supporters of former President Trump, and even Trump himself. Whilst such cancellations are not all related to COVID-19 regulations, they demonstrate the measures which banks are already taking to enforce political agendas.

Tucker Carlson recently revealed that Bank of America flagged customers’ purchasing histories and sent it to the federal government in order to attempt to identify people who were involved with the pro-Trump January 6 protest in Washington, D.C. “Bank of America is effectively acting as an intelligence agency – but they’re not telling you about it,” warned Carlson.

Bank of America identified 211 customers who met “thresholds of interest” – transactions made in Washington, D.C. on January 5 or 6; any purchases for hotels or AirBnbs in D.C., Maryland, or Virginia after January 6; any purchase of weapons or at a weapons-related merchant (“t-shirts included,” noted Carlson) between January 7 and “the upcoming suspected stay in D.C. area around Inauguration Day”; and “airline related purchases” since January 6 – and turned them over to the government.

The heavy-handed actions of these banks have some origin in Klaus Schwab’s writings. Schwab described an example of how the green-based financial future could unfold, saying that climate activists will become “emboldened,” and will “redouble their efforts, imposing further pressure on companies and investors.” “Let’s imagine the following situation to illustrate the point,” he wrote. “A group of green activists could demonstrate in front of a coal-fired power plant to demand greater enforcement of pollution regulations, while a group of investors does the same in the boardroom by depriving the plant access to capital.” The scenario described by Schwab is not difficult to imagine, when examining the amount of banks who have committed to advancing green policies.

Speaking in December, Lael Brainard of the Federal Reserve’s governing board, shed further light on the amount of money controlled by green-centered banks. Referencing the Task Force on Climate-Related Financial Disclosures (TCFD), which “provides a consistent global framework for companies and other organizations to improve standardization of climate-related financial disclosures,” Brainard said: “As of October 2020, nearly 1,500 organizations with a combined market capitalization of $12.6 trillion, including financial institutions that own or manage assets of $150 trillion, had expressed their support for the TCFD framework.”

Back in 2019, when its members only numbered 34, (as opposed to the current 83), the NGFS revealed that the banking jurisdiction of its members covered “31%” of the global population, and “44% of the global GDP.”

The NGFS adds that now its members are responsible for supervising “all of the global systemically important banks and two thirds of global systemically important insurers.”

Then in its recent progress report from December 2020, the group proposed “selective divestment” and even financial “activity-based exclusions,” for companies that were not in line with climate change polices, or so called “Paris aligned investing.”

“Of course, such discrimination is exactly what NGFS – now including the Fed – intends,” wrote Breitbart’s Virgil, “to use the power of discriminatory finance to force industries, companies, and people to go green. Either that or cease to exist altogether.”

yogaesoteric

February 26, 2021