World war, if started, will not be won by anyone, as everybody will only have to lose…

by Tapestry

tapnewswire.com

US/NATO expansion/military operations are said to be a process designed to end in a One World Government. On the other hand, the Russians claim their military is decades ahead of the West, and that they are currently arming Iran, Turkey, India, the Philippines and numerous other countries, including China, which has capabilities that are also going ahead rapidly. The Illuminati’s plans for a One World Government only require Western arrogance and stupidity to get a world war started.

If such a world war would be unleashed, before too long, the West would find themselves retreating on all fronts, and in time, after a long and grueling war has been fought, with tens of millions of deaths, a One World Government would be result. However, it would not be based in New York, but more likely in China. Before the Illuminati take it over and run the world openly declaring Lucifer and Satan as the new Gods, and all other religions no longer permitted, the formerly Christian West, in its ludicrous condition of hopelessness, will be easily crushed.

While the eventual military outcome of a World War III looks fairly certain, just looking at recent confrontations where the US/NATO have been unable to achieve hardly anything, one can only guess at the economic effects of such a war. Even without a war, the economic situation of the West is dire.

Some believe the US would be capable of achieving world hegemony, forming the One World Government from Washington. Yet the time for that has already passed. The West needs to rethink its defense as exactly that – how to defend, and not how to attack. It won’t take Russia and China long to sink the US navy, down satellites and cut off the hundreds of US military bases around the globe. Then the questions will be: Can America defend America? Can Europe defend Europe?

Hopefully, somehow such a war will never happen, but it will be not thanks to Trump, May, Macron etc, who seem to be playing the role of Illuminati agentur.

New Study: US Economy Actually About to Sink

Risking World War III, catastrophic economic prospects push the desperate US regime in a crazed hurry to attempt the establishment of an absolute world hegemony.

The US economy is about to go belly-up within 5 to 10 years, threatening to take the empire down with it. At the same time, China and Russia continue their meteoric rise economically, technologically, and militarily. This is why the US Deep State regime is in a crazed hurry to attempt the establishment of an absolute world hegemony within the few years before the window of opportunity for the New World Order shuts forever.

America is sinking. Will she take the whole world down with her?

This is why the US and its European vassal regimes have been stepping up their hostilities, trade wars and military provocations against Russia and China.

The Western globalist elite is desperate, therefore literally anything can happen. The fate of the whole world is at stake as the United States tackles its sinking economy.

A fresh study by Awara Accounting shows that two decades of debt-fueled sham growth, creative accounting practices and war spending has pushed the US economy to the brink. It is therefore doubtful whether the already exhausted US economy can bear the additional stress from the massive drive to expand the US global hegemony, the increased confrontation and arms race with Russia and China, as well as the incipient trade war with China. Most probably it can’t.

Following, we offer excerpts from that study.

Skyrocketing interest on the ballooning US government debt might gobble up 25% of the budget

The already enormous US debt is ballooning as the government borrows trillions to keep the economic bubble in the air and to imitate growth. The US federal budgets for 2018 and 2019 and the 10-year projection will create huge deficits, adding yet more debt to the tune of a trillion dollars per year – according to official projections – until 2023. Our analysis shows that the actual borrowings might vastly exceed that, inflating the debt balloon by $10 trillion, or more, in just five years, and reaching 140% of GDP by 2024.

But new global economic realities have clouded the prospects of the US being able to count on continuous low-interest financing of its deficits. Following predictions of mounting debt and interest costs, even the government has factored in an almost 150% rise in annual interest expenditure by 2028, reaching $760 billion. We predict (concurring with other analysts) that the interest expenditure is very likely to actually swell twice as much and reach an annual $1.5 trillion by 2028. That’s a totally unsustainable level, and even double the size of the war budget for 2028 (as per the government’s 10-year plan). $1.5 trillion on interest would mean 25% of the total budget, compared with 7% in 2018. There is no way that the US economy can afford that cost. But because of skyrocketing social costs and the war budget priorities, the budget offers no flexibility, even when everything else is being thrown overboard.

In view of this, it is clear that the present US economic system will not survive beyond the next 5 to 10 years. Massive changes in the economic model would have to be undertaken either in an organized fashion (hardly imaginable) or through a mega financial crisis. Ultimately this would lead to a permanent downgrading of US standards of living as the economy would have to adjust back to its pre-financial bubble level of $14.5 trillion (a 30% drop from present debt-fueled level). Following these cataclysmic adjustments, the US would lose its economic hegemony and hegemonic military power. This would give a per capita GDP of just above $30 thousand, almost on par with Russia’s present $28 thousand per capita.

There has been no real GDP growth since 2007

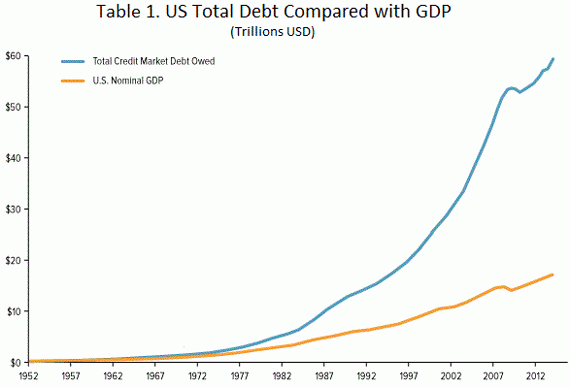

We argue that there has been no real GDP growth since at least the 2007 – 2008 crisis – and most probably since 2000 when the tech bubble burst. The semblance of growth has merely been created by way of massive borrowings in all sectors of the economy: public and private, corporate and household. Starting with deregulation and liberalization of the capital markets (and the speculation it entailed) in the late 70s and 80s debt growth accelerated above growth of the underlying economy and really shot off in the wake of the two financial market crises. (Table 1). An even earlier turning point can be identified in 1971 when the U.S. abandoned the gold standard. Whereas, the size of the debt has historically corresponded to the size of the underlying economy, the level of US total debt (public and private) is now 3 times higher than the GDP.

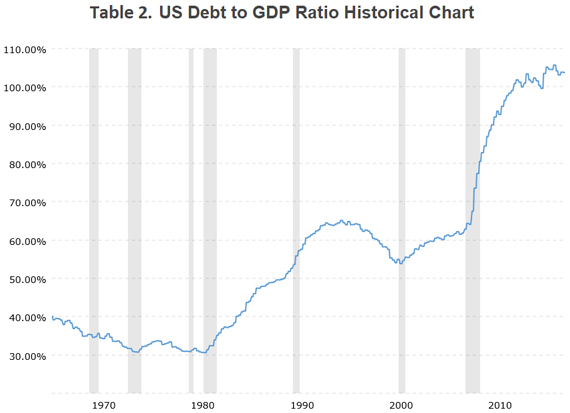

After the 2007 financial crisis, households lost their capacity to rack up more debt, but since then the government has stepped in to make up for the shortfall with its colossal borrowings in order to keep the economy floating. Table 2 illustrates the precipitous rise of national debt (government debt) over the GDP since 1980 – beginning of market liberalization – and again after 2000, in the wake of the tech bubble crisis.

In fact, the US government debt is higher than what is shown in the above graph. This is because contrary to global practices, the US only reports the debt of federal government failing to report debt of states and municipalities (local debt). With local debt, the US debt-to-GDP ratio would be 125%, which is the correct indicator for global comparisons.

In addition to that reporting fallacy, the US government also has a peculiar habit of knocking out a third of the debt when it reports the figures of so-called public debt instead of total national debt. By public debt they mean debt held by the public as opposed to intra-governmental debt, whereas the term “public debt” in global practices is a synonym to national debt (and government debt, too). Most often in the American discussion only this perverted public debt figure is reported, thus ignoring 40% of the actual debt.

Growth of government debt has exceeded GDP growth manifold

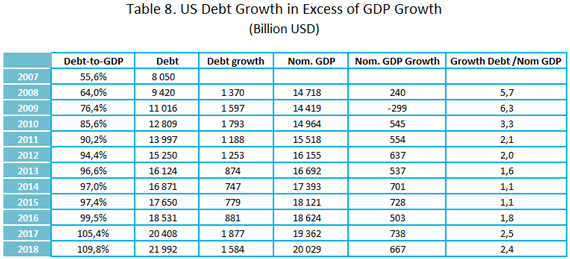

Not only has there been no real GDP growth, but even the nominal growth has to a crucial extent been provided for by means of the enormous government borrowings. The table below shows that that in each year 2008 to 2017 even nominal GDP growth has been less than growth of government debt.

In every single year since 2007 up till now, the amount of new debt has exceeded the nominal GDP growth. In the peak crisis years 2008 and 2009, debt growth was a staggering 5.7 and 6.3 times that of the GDP growth. In all other years, debt growth remained at levels of two times GDP growth, except 2014 and 2015 when they were on par.

US government cooks the books

We wrote above that the US government has been rather cavalier with its practices of reporting the size and structure of national and public debt. But the creative accounting practices do not stop there. They have actually tampered with (aka “reformed”) the methodology on how inflation is measured in order to underreport actual inflation rates. By under-measuring inflation, the government has been able to overstate GDP growth by means of reclassifying price inflation as supposed qualitative and quantitative improvements.

The bottom line of this is that we cannot trust the US government figures on inflation and by implication its GDP growth figures. John Williams’ Shadow Government Statistics has calculated inflation according to the methodology, which was employed by the government’s Bureau of Labor Statistics prior to 1990, before all the tricks following the “reforms” came to use. These alternative inflation statistics indicated that the actual inflation was about 2 percentage points above the officially reported up to 2007, after which the gap widened to a persistent level of 4 percentage points.

US economy resembles a giant Ponzi scheme

It is fair to say that very little of the enormous debt load has gone into productive investments for the future, and instead has been wasted in momentarily consumption and on costly overseas wars and subsidies to the military-industrial complex. An enormous bubble has been created – and it will go on inflating as the new debt must not only be high enough to maintain the bubble at the previous level but also high enough to generate a semblance of growth. It is exactly like in a Ponzi scheme where constantly more money is needed to build up the asset scam while paying off the earlier investors. The latter corresponds to consumption waste but also to corruption rent in form of pay-offs to the elite stakeholders, the so-called One Percent. This is precisely the reason why the richest 1 percent bagged 82% of all new wealth created in 2017 and the poorest half of humanity got nothing.

War budgets ripping open huge deficits

As if that wasn’t bad enough, the future promises to be worse thanks to the recent budget-busting tax cuts and spending deals. This March, the US national debt soared over the $21 trillion mark, only weeks before the Congress passed its record $1.3 trillion discretionary budget bill for fiscal year 2018 with a record $700 billion for the military-industrial complex.

But a far scarier reading is Trump’s budget for 2019 and the ten-year projections which came with it. Even though these budgets rely on extremely optimistic and unrealistic economic growth assumptions they foresee enormous deficits to the tune of $1 trillion for each year up to 2023. There is then the wishful idea that after 2023 there would supposedly be a turnaround leading to shrinking deficits and only a 1.1% budget deficit by 2023.

That is not going to happen. On the contrary, the actual deficits will be even higher. Committee for a Responsible Federal Budget (CRFB) forecasts that not only will there be no turnaround in deficit growth, but the deficits will continue to grow at a crazed rate reaching an annual $2.4 trillion by 2028, which is closer to 7 times higher than the official prediction. Cumulatively over the 10 years, the CRFB projections would add $10 trillion to the debt over the government’s forecast.

We think that the future prospects are even gloomier than that. As we showed above, the US government has continuously been racking up new debt even in excess of the nominal GDP growth, borrowing more than needed to patch up the annual deficits. We therefore, assume in our baseline scenario that the US government’s annual net borrowing needs will exceed the nominal GDP by 3%. This would mean that the net increase in debt could be as enormous as $10 to 15 trillion in just five years 2019 to 2024. Such massive borrowings would spell ruin to the economy.

Unfunded liabilities will now become due

While military spending makes up a huge and growing share of the federal budget, it is actually social spending (pensions, health care), which forms the biggest portion of the present budget and will grow vastly more than the military spending according to the 2028 projections.

In the 2018 budget, pensions (Social Security) accounted for 24% of the total or $987 billion, whereas they now are projected to grow by 77% to reach $1,748 billion by 2028 with a share of 28%. The health care costs (Medicare) with a present share of 24% worth $982 billion would in the same time jump by 89% to $1,854 billion, a share of 29%.

The ballooning social security and health care costs will not come due to some newfound social inclinations in Trump’s way of thinking, rather there is no choice. The Medicare trust fund is projected to run out of money in seven years, Social Security Disability in five, and Social Security retirement in 12, according to the nonpartisan Congressional Budget Office.

Economists have calculated that the value of the unfunded liabilities on Social Security and Medicare range anywhere between $46.7 trillion to $210 trillion. The calculations are based on assessing the difference between the amount of the present value (their discounted value as of today) of all benefits which will have to be paid out in the future years and the present value of the projected tax revenue designated to pay for those benefits. It is worth pointing out that the $46.7 trillion unfunded liabilities figure is not based on just any economist’s alarmist calculations but actually comes from the official Financial Report of the US Government for year 2016 compiled by US Department of Treasury.

The government cannot any longer count on dipping into Social Security to continue funding its deficits when it instead must pump in more money in the system. There is very little, if any, leeway to cut spending as it, on the contrary, would have to be stepped up.

As a result of the decade long zero-interest debt binge, private pension plans have lost in value and cannot alleviate the problem either. (One of the big reasons why interests must be raised).

In addition to these skyrocketing social and health care costs there is the projected exorbitant interest expenditure, and of course the military budget. In order to scrape together a budget with presentable deficits, the Trump administration has projected only a 25% increase in military spending over ten years, from $700 billion in 2018 to $783 in 2028. Of course, that will not happen, so the actual spending on the military will rip open ever wider deficits.

Then, as reported above, the exorbitantly rising interest costs will deliver the final blow to the US budget – and the whole economy.

Why the US cannot keep printing money

Frequently, a discussion on the dire prospects of the US economy and its debt problem ends with the prediction that the Fed will just keep financing it by purchasing treasury securities (aka quantitative easing aka money printing). But in reality, that is not an option. The Fed’s recent interest hikes from the lows of 0.25% to 1.5% – 1.5% show that they have realized that the economy cannot permanently function in an administratively decreed zero-interest environment.

The Fed may have already caused permanent and fatal damage to the US economy by organizing the decade long zero-interest debt orgy. The US economy has been turned into a giant bubble economy detached from all fundamental market mechanisms. It is even doubtful if the United States can still be called a market economy. In a real market economy, it would never have been possible to press by fiat interest rates down to zero without the other components of a financial system – currency exchange values, inflation, risk premiums – reacting in different directions. In actual fact, it has not been possible in the US either, the complications – as we have seen – have been building up and have now reached the near breaking point. Fed financing has stoked the asset bubbles with misallocated credit that has been used for financial speculation and corporate stock buyback.

The US has got away with it for nearly two decades thanks to the strong starting point and by means of manipulating the dollar currency monopoly. The latter, as all monopolies, has been a deceptive advantage: it has enabled the US to live above its means for decades, but now the bill is due. In the American form of planned economy, the Fed has functioned like a central planning organ similar to the USSR State Planning Commission, the Gosplan, with the difference that it has not strived to set the prices of each and all goods and services separately – as it was in the planned economy of the Soviet Union – instead it has fixed the price of the most important of all goods, namely the price of money, by administratively decreeing the interest rates without regard to market mechanisms, coupled with a manipulation of currency exchange rates.

No economy can perpetually ignore the laws of market economies. The USSR did it until it failed, China did it, until it embarked on its astonishing economic recovery. The Americans, too, will soon have to refresh all they used to know about the fundamentals of market economy.

Other creditors will demand an interest

It is hard to imagine that the bulk of the funding of the gargantuan borrowings could come from anybody else than the Fed (directly or indirectly). But as we have seen, it is also highly unlikely that they could continue doing so to those exorbitant levels and below real market rates. The viability of the US economy will require that the conditions of market economy are returned, and in particular the pension bomb requires that pension savings plans earn a sufficient yield.

With these borrowing needs, the Fed could not possibly continue this extravaganza without the risk of hyperinflation becoming very real. Therefore, the US must be able to attract funding on market terms from domestic and foreign sources, which requires market-based interests. The incipient trade war with China and Make America Great Again protectionism will inevitably raise inflation rates. While inflation, as we report, has been substantially higher than what the government wants us to think, it has anyway been low in proportion to the massive debt leverage. Instead real estate and stock prices have inflated and sucked up the pressure. With present levels of the asset bubble this cannot go on perpetually either and therefore inflation will inevitably be felt in consumer prices. Also, these levels of share prices will push the corporations to raise the prices of their products, as they have to try to show revenue proportionate to their share prices.

At the same time foreign funding is drying up as countries like Russia are striving to de-dollarize their economies and foreign trade, and China is working on establishing itself as a world financial power, setting up its own benchmark quotations for commodities such as gold and attempting to dethrone the petrodollar with its petroyuan.

yogaesoteric

July 20, 2018