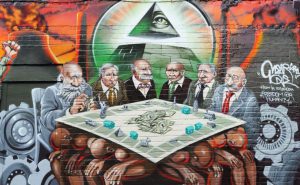

Historical Analysis of the Global Elites: Ransacking the World Economy Until ‘You’ll Own Nothing’ (1)

According to a video published by the World Economic Forum in 2016, by 2030 ‘You’ll Own Nothing. And You’ll Be Happy.’

Clearly, if this prediction is to come true, then many events need to take place. Let me identify why the World Economic Forum believes it will occur and then investigate these claims. Among other questions, I will examine whether those who will own nothing will include the Rothschild, Rockefeller and other staggeringly wealthy families. Or, perhaps, whether they just mean people like you and me.

In fact, a primary intention behind the Elite’s ongoing technocratic coup, initiated in January 2020, is to trigger a process of depopulation, as well fundamentally reshape world order including by turning those humans left alive into “transhuman slaves”, drive the global economy to collapse and implement the final redistribution of global wealth from everyone else to this Elite.

Let me start with the briefest of histories so that what is taking place can be understood as the ultimate conclusion of a long-standing agenda, identify who I mean by the ‘Global Elite’ (and its agents), then present the evidence to explain how this is occurring and, most importantly, a comprehensive strategy to defeat it.

Needless to say, in the interests of keeping this study manageable, many critical historical events – including how imperialism and colonialism, the international slave trade, a great number of wars and coups, Wall Street support for the Bolshevik Revolution in Russia in 1917 and precipitation of the Great Depression in 1929, were used to advance the Elite program – are not addressed in this investigation. But for accounts of the latter two events which provide evidence consistent with the analysis offered below, see Wall Street and The Bolshevik Revolution and The Secrets of the Federal Reserve.

A Brief Economic History

Following the Neolithic revolution 12,000 years ago, agriculture allowed human settlement to supersede the hunter-gatherer economy. However, while the Neolithic revolution occurred spontaneously in several parts of the world, some of the Neolithic societies that emerged in Asia, Europe, Central America and South America resorted to increasing degrees of social control, ostensibly to achieve a variety of social and economic outcomes, including increased efficiency in food production.

Civilizations emerged just over 5,000 years ago and, utilizing this higher degree of social control, were characterized by towns or cities, efficient food production allowing a large minority of the community to be engaged in more specialized activities, a centralized bureaucracy and the practice of skilled warfare. See A Critique of Human Society since the Neolithic Revolution.

With the emergence of civilization, elites of a local nature (such as the Pharoahs of Egypt), elites with imperial reach (including Roman emperors), elites of a religious nature (such as Popes and officials of the Vatican), elites of an economic character (particularly the City of London Corporation) and elites of a ‘national’ type (especially the monarchies of Europe) progressively emerged, essentially to manage the administration associated with maintaining and expanding their realms (political, economic and/or religious).

The Peace of Westphalia in 1648 formally established the nation-state system in Europe. Enriched by the long-standing and profitable legacy of their control over local domestic populations, support for the imperial conquest of non-European lands, colonial subjugation of indigenous peoples and the international slave trade, European elites, backed by military violence, were able to impose a long series of changes over national political, economic and legal systems which facilitated the emergence of industrial capitalism in Europe in the 18th century.

These interrelated political, economic and legal changes facilitated scientific research that was increasingly geared towards utilizing new resources and technological innovation that drove the ongoing invention of machinery and the harnessing of coal-fired power to make industrial production possible.

Beyond this, and following several centuries of more and less formal versions of it, Elite political and economic imperatives drove the ‘legal’ enclosure of the Commons to force people off their land and into the poorly-paid labour force needed in the emerging industrial cities. In these cities, an ongoing series of developments in the organization of work in factories, electrification, banking, and other changes and technologies dramatically expanded the gap between rich and poor. Along with subsequently imposed changes to education and, later, healthcare, national economies and the global economy were increasingly structured to profoundly disconnect ‘ordinary’ people from their land, traditional knowledge and long-standing healthcare practices to make them dependent while dramatically reinforcing an institutional reality progressively consolidated since the dawn of human civilization: Elite control ensured that the economy perpetually redistributed wealth from those who have less to those who have more.

As noted by Adam Smith, for example, in his classic work An Inquiry into the Nature and Causes of the Wealth of Nations published in 1775: “All for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind”.

And this was exemplified, for example, by the 150-year struggle between the bankers working to establish a privately-owned central bank in the newly independent United States and those Presidents (such as Andrew Jackson and Abraham Lincoln) and members of Congress who worked tirelessly to defeat it. In fact: “Most of the founding fathers realized the potential dangers of banking and feared bankers’ accumulation of wealth and power.” Why?

Having observed how the privately-owned British central bank, the Bank of England, had run up the British national debt to such an extent that Parliament had been forced to place unfair taxes on the American colonies, the founders in the US understood the evils of a privately-owned central bank, which Benjamin Franklin later claimed was the real cause of the American Revolution.

As James Madison, principal author of the US Constitution argued: “History records that the Money Changers used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money, and its issuance.” Another founder, Thomas Jefferson, put it this way: “I sincerely believe that banking institutions are more dangerous to our liberties than standing armies. The issuing power should be taken from the banks and restored to the people to whom it properly belongs.” As it turns out, the battle over who would get the power to issue US money raged from 1764, changing hands eight times, until the bankers’ final deceitful victory in 1913 with the establishment of the Federal Reserve System. “The battle over who gets to issue our money has been the pivotal issue throughout the history of the United States. Wars are fought over it. Depressions are caused to acquire it. Yet after WWI, this battle was rarely mentioned in the newspapers or history books. Why? By WWI, the Money Changers with their dominant wealth had seized control of most of the nation’s press.” Watch The Money Masters: How International Bankers Gained Control of America.

Why the objection to a private central bank? Well, consider the formation and ownership of the inaccurately named Bank of England, established in 1694.

By the end of the C17th, England was in financial ruin: 50 years of more or less continuous wars with France and Holland had depleted it. So government officials asked the bankers for the loans necessary to pursue their political purposes. What did these bankers want in return? “The price was high: a government-sanctioned, privately owned bank which could issue money created out of nothing.” It became the world’s first privately-owned central bank and, although it was deceptively called the Bank of England to make people think it was part of the government, it was not. Moreover, like any other private corporation, the Bank of England sold shares to get started. “The investors, whose names were never revealed, were supposed to put up 1,250,000 British pounds in gold coins, to buy their shares in the bank. But only 750,000 pounds was ever received.” Despite that, the bank was duly chartered in 1694 and started the business of loaning out several times the money it supposedly had in reserves, all at interest.

Let me restate that for clarity: The British government legislated to create a privately-owned central bank (that is, a bank owned by a small group of wealthy individuals) that loaned out vast amounts of money it did not have so that it could make a profit by charging interest.

This practice is called “fractional reserve banking” to make it sound like some sophisticated economic concept rather than a deceitful practice that, should you or I do it, we would be jailed. “In exchange the Bank would loan the British politicians as much of the new currency as they wanted, as long as they secured the debt by direct taxation of the British people.” In other words, the Bank could not lose.

So, as William T. Still notes: “legalization of the Bank of England amounted to nothing less than the legal counterfeiting of a national currency for private gain.”

“Unfortunately”, he goes on, “nearly every nation now has a privately controlled central bank, using the Bank of England as their basic model. Such is the power of these central banks, that they soon take total control over a nation’s economy. It soon amounts to nothing else than a plutocracy, rule by the rich.”

Before proceeding, if how the banking system works isn’t your strong point, a brief video does a good job of spelling out essential points in a non-technical way. Watch Banking – the Greatest Scam on Earth.

And for a thoughtful explanation of the meaning and history of money, see Nick Szabo’s superb article Shelling Out: The Origins of Money.

In any case, the fundamental point is simple: After 5,000 years, the various processes by which local elites, then ‘national’ elites, then international elites, and now the Global Elite have continuously asserted their control to enhance their capacity to shape how the world works and to accumulate wealth has now reached its climax. Thus we are on the brink of being herded into an Elite-controlled technocracy in which, as the World Economic Forum makes clear: By 2030 “You’ll Own Nothing. And You’ll Be Happy.”

So you will own nothing. And why would you be happy about that? Because you will be a transhuman slave: an organism that no longer even owns their own consciousness.

Who is the Global Elite and How does it Operate?

Many authors have, directly or indirectly, addressed this question and each has come up with their own nuanced combination of wealthy people and families, their political connections, as well as the financial instruments and organizational structures through which their power is gained and exercised.

For the purposes of this study, I am going to define the Global Elite as those families that had acquired their vast wealth and firmly established their preeminent political and economic power in global society by the end of the 19th century. These families have thus played the central role in shaping institutions and events both before but also since that time, thus providing the framework in which other wealthy people have since emerged.

In order to perform their fundamental role in shaping the modern world to serve their purposes, this Elite has facilitated the creation of a vast network of agents – corporations, institutions, other families and persons – who are owned and/or controlled by this Elite and act as ‘fronts’ to advance Elite interests. In any given period, the Elite families remain largely unchanged (while succeeding generations of people further the families’ interests) but the organizational and personal agents through which these families work vary, depending on Elite aims in the contexts it precipitates.

Let me briefly illustrate my approach by using one family – the House of Rothschild – as a case study before moving onto a wider description of how Elite families use their wealth to shape corporations, institutions, events and people to serve their own purposes.

This example is drawn from the official Rothschild Archive and two (sometimes conflicting) Rothschild-authorized accounts of the family’s history written at different times. See The House of Rothschild – Money’s Prophets, 1798-1848 and The Rothschilds: A Family Portrait.

In addition, the account draws on sources that report neutrally on Rothschild involvement as well as some sources that are critical. These sources are cited in context below.

By the mid-18th century, the ancestors of Mayer Amschel had long been small merchants in the town ghetto of Frankfurt. But, as a Jew without a family name and before street numbering was used, Mayer was also known by the name some ancestors had used on the house sign where they once lived: Rothschild (Red Shield). With more ability than other merchants and having been sent to learn the rudiments of business in the firm of Wolf Jakob Oppenheim, he became a dealer in rare coins, medals and antiques, the buyers of which were almost invariably aristocratic collectors, including William, Hereditary Prince of Hesse-Kassel. It was this business that enabled Mayer Amschel to accumulate the capital to move into banking, a natural outgrowth of his policy of extending credit to some of his clients. His wealth started to increase rapidly as he focused more on state and merchant banking, both local and international.

With a policy of seeking little profit from interest on loans while seeking trade concessions in other areas, seeking clientele only among ‘the noblest personages in Germany’, secret bookkeeping in parallel with the official one and, later, deploying his five sons to replicate his style and activities in England (Nathan, who, after a few years in Manchester, established himself in the City of London), Paris (Jakob, known as James), Naples (Kalman, or Carl), Vienna (Salomon) as well as Frankfurt (where eldest son Amschel eventually succeeded father Mayer), the Rothschild dynasty and ‘multinational business model’ quickly established itself throughout Europe. Critically, it was serviced by the maintenance of close relationships with leading political figures and salaried agents working in financial markets who provided essential political and commercial news, as well as private communications channels (including coaches with secret compartments) that worked with enormous efficiency.

And it was this ‘Red Shield’ communication network, later operating under Royal patronage, combined with a certain audacity, that enabled the Rothschilds to profit handsomely from a variety of adverse circumstances including the restrictions on trade between England and the continent which characterized the Napoleonic period, and the Napoleonic Wars as well. This included smuggling vast amounts of contraband goods from England to the continent and transferring a substantial hoard of gold bullion through France to finance the feeding of Wellington’s army.

Most spectacularly, and despite family efforts to suppress awareness of this fact, the Rothschilds profited enormously from their privileged notice that Wellington defeated Napoleon at Waterloo in 1815, as recorded by William T. Still and Patrick S.J. Carmack in their 3.5 hour documentary The Money Masters: How International Bankers Gained Control of America mentioned above.

How did this occur?

Following a long series of wars across Europe and the western Mediterranean, during which he was very successful, rapidly promoted and, in 1804, elected Emperor of France, Napoleon was eventually defeated. He abdicated and was exiled to Elba, an island off the Tuscan coast, in 1814 but escaped nine months later in February 1815.

As he returned to Paris, French troops were sent out to capture Napoleon but such was his charisma that “the soldiers rallied around their old leader and hailed him as their emperor once again.” And, having borrowed funds to rearm, in March 1815 Napoleon’s freshly equipped army marched out to be ultimately defeated by Britain’s Duke of Wellington at Waterloo less than three months later. As Still remarks: “Some writers claimed Napoleon borrowed 5 million pounds from the Bank of England to rearm. But it appears these funds actually came from Ubard Banking House in Paris. Nevertheless, from about this point on, it was not unusual for privately controlled central banks to finance both sides in a war.”

“Why would a central bank finance opposing sides in a war?” Still asks. “Because war is the biggest debt generator of them all. A nation will borrow any amount for victory. The ultimate loser is loaned just enough to hold out the vain hope of victory, and the ultimate winner is given enough to win. Besides, such loans are usually conditioned upon the guarantee that the victor will honor the debts of the vanquished.”

While the outcome of the battle at Waterloo was certainly in doubt, back in London Nathan Rothschild planned to use the outcome, no matter who won or lost, to try to seize control over the British stock and bond market and possibly even the Bank of England. How did he do this? Here is one account. “Rothschild stationed a trusted agent, a man named Rothworth, on the north side of the battlefield, closer to the English Channel.” Once the battle had been decided, at the cost of many thousands of French, English and other European lives, Rothworth headed immediately for the Channel. He delivered the news to Nathan Rothschild, a full 24 hours before Wellington’s own courier arrived with the news.

Rothschild hurried to the stock market and, with all eyes on him given the Rothschild’s legendary communications network was well known, others present observed Rothschild knowing that if Wellington had been defeated, and Napoleon was again at large in Europe, the British financial situation would become grave indeed. Rothschild began selling his consoles (British government bonds). “Other nervous investors saw that Rothschild was selling. It could only mean: Napoleon have won, Wellington have lost.”

The market plummeted. Soon everyone was selling their own consoles and prices dropped sharply. “But then Rothschild started secretly buying up the consoles through his agents for only a fraction of their worth hours before.”

Fallacious? As Still concludes this recounting of the episode: “One hundred years later, the New York Times ran the story that Nathan Rothschild’s grandson had attempted to secure a court order to suppress a book with that stock market story in it. The Rothschild family claimed that the story was untrue and libelous. But the court denied the Rothschilds’ request and ordered the family to pay all court costs.”

In any case, having built their initial fortune using various means – some of which, as just illustrated, were neither moral nor legal – throughout the 19th century the Rothschild family continued to accumulate wealth through the international bond market, which they played a key role in developing, as well as other forms of financial business: bullion broking and refining, accepting and discounting commercial bills, direct trading in commodities, foreign exchange dealing and arbitrage, even insurance. The Rothschilds also had a select group of clients – usually royal and aristocratic persons whom they wished to cultivate – to whom they offered a range of ‘personal banking services’ ranging from large personal loans (such as that to the Austrian Chancellor Prince Metternich) to a first class private postal service (for Queen Victoria). The family also had substantial mining interests and was a major industrial investor backing the construction of railway lines in Europe in the 1830s and 1840s. But, apart from its other interests, the family continued to be heavily involved in ‘the money trade’.

“From 1870 onwards, London was the centre of Britain’s greatest export: money. Vast quantities of savings and earnings were gathered and invested at considerable profit through the international merchant banks of Rothschild, Baring, Lazard, and Morgan in the City”. See Hidden History: The Secret Origins of the First World War, p. 220.

But what, exactly, is the City?

The City of London Corporation, an independent square mile in the heart of London, was founded in about AD50 and quickly established itself as an important commercial centre which ultimately gave birth to some of the world’s greatest financial institutions such as the London Stock Exchange, Lloyd’s of London and, in 1694, the Bank of England. The City’s ‘modern period’ is sometimes dated from 1067.

However, as explained by Nicholas Shaxson, the City “is an ancient, [semi-foreign] entity lodged inside the British nation state; a ‘prehistoric monster which had mysteriously survived into the modern world’, as a 19th century would-be City reformer put it, the corporation is an offshore island inside Britain, a tax haven in its own right.” Of course, the term “tax haven” is a misnomer, “because such places aren’t just about tax. What they sell is escape: from the laws, rules and taxes of jurisdictions elsewhere, usually with secrecy as their prime offering. The notion of elsewhere (hence the term ‘offshore’) is central. The Cayman Islands’ tax and secrecy laws are not designed for the benefit of the 50,000-odd Caymanians, but help wealthy people and corporations, mostly in the US and Europe, get around the rules of their own democratic societies. The outcome is one set of rules for a rich elite and another for the rest of us.”

In the words of Shaxson: “The City’s ‘elsewhere’ status in Britain stems from a simple formula: over centuries, sovereigns and governments have sought City loans, and in exchange the City has extracted privileges and freedoms from rules and laws to which the rest of Britain needs to submit. The City does have a noble tradition of standing up for citizens’ freedoms against despotic sovereigns, but this has morphed into freedom for money.” See The tax haven in the heart of Britain.

As Gerry Docherty and Jim Macgregor explain it then, by 1870:

“City influence and investments crossed national boundaries and raised funds for governments and companies across the entire world. The great investment houses made billions, their political allies and agents grew wealthy. Edward VII, both as king and earlier as Prince of Wales, swapped friendship and honours for the generous patronage of the Rothschilds, Cassel, and other Jewish banking families like the Montagus, Hirschs and Sassoons. The Bank of England was completely in the hands of these powerful financiers, and the relationship went unchallenged.

The flow of money into the United States during the nineteenth century advanced industrial development to the immense benefit of the millionaires it created: Rockefeller, Carnegie, Morgan, Vanderbilt and their associates. The Rothschilds represented British interests, either directly through front companies or indirectly through agencies that they controlled. Railroads, steel, shipbuilding, construction, oil and finance blossomed. These small groups of massively rich persons on both sides of the Atlantic knew one another well, and the Secret Elite in London initiated the very select and secretive dining club, the Pilgrims, that brought them together on a regular basis.” See Hidden History: The Secret Origins of the First World War, p. 220.

To choose one example from those just listed, you can read an official account of the Rothschild family’s early involvement in oil production, including its “decisive influence” in the formation of Royal Dutch Shell, in the Rothschild Archive. See the chapter: ‘Searching for Oil in Roubaix’.

Beyond their investments in the industries just listed, however, the Rothschilds had significant media interests: Their Paribas Bank “controlled the all-powerful news agency Havas, which in turn owned the most important advertising agency in France.” See Hidden History: The Secret Origins of the First World War, p. 214.

And, by the late 19th century, direct Rothschild investment in major ‘armaments companies’ (now better known as weapons corporations) and related industries was substantial with official biographer Niall Ferguson candidly noting “If late-nineteenth-century imperialism had its ‘military-industrial complex’ the Rothschilds were unquestionably part of it.” See The House of Rothschild – Volume 2 – The World’s Banker, 1849-1998, p. 579.

Read the second part of the article

Analysis by Robert J. Burrowes

yogaesoteric

January 30, 2023