The World Bank has an insurance policy against pandemics

In a possibly unrelated aside, the World Bank has an insurance policy against pandemics but unless certain conditions occur, it won’t pay out, which greatly benefits investors. It has been used the word “unrelated” because apparently the bonds aren’t dependent on the WHO’s classification of an outbreak.

According to the World Bank, which created the fund three years ago, it was designed to “swiftly funnel funds from the deep-pocketed financial sector to health authorities in poorer countries before international assistance could be mobilized.”

They sold $320 million of these securities, which will mature in July of this year. If it matures, investors could receive double-digit yields. If a pandemic does occur, however, they could lose every penny they put into the fund.

A World Health Organization (WHO) situation report on Sunday March 29 catalogued 634,835 cases of coronavirus Covid-19 across 200 countries and territories, causing 29,821 deaths. In 2017 the World Bank issued a pandemic bond designed to help fund the response to any widespread outbreak of a number of diseases, including coronavirus. The $320 million bond was part of a bigger $425 million risk transfer that included a concurrent $105 million swap with six reinsurance counterparties.

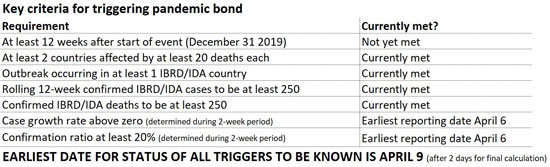

Should it already be paying out? As of March 16, the answer was no, principally because the required time period has not yet elapsed since the start of the outbreak, which is 84 days, or 12 weeks. The World Bank confirmed to Euromoney on March 5 that the official start of the outbreak has been set at December 31, 2019, meaning that the first day following the 12-week period it was March 24. Contrary to rumours circulating online, there was no requirement for a body like the World Bank or the World Health Organisation to formally declare that the outbreak is a pandemic for the bonds to pay out. When the criteria are met, the bonds will be triggered, whether or not a pandemic has been declared. However, the WHO did in any case declare a pandemic as of March 11.

Some of the bond trigger criteria have been met, but two – the growth rate of cases and the ratio of confirmed cases to total cases (including suspected) – can only be calculated after the initial 84 days, and are determined during an additional period of up to two weeks. The growth rate calculation is particularly problematic: in the case of coronavirus, it is calculated on the basis of individual IBRD or IDA countries only, meaning that it is highly dependent on those countries’ ability to test and report cases. It is also difficult to assess externally because it uses for its calculation the total case amount, which includes probable cases that are not routinely reported publicly by the WHO in its situation reports. The timeframe means that although March 24 marked the end of the 12-week period since the start of the outbreak, the growth rate and confirmation ratio data that relate to that day would not be known until April 6. Two days is then set aside for calculation of those rates. On that basis, Euromoney understands that the earliest date on which it would be known if all bond trigger conditions have been met is April 9.

If the scheme does pay out, it will do so only to a very targeted group of countries – the poorest in the world, which are also those with the weakest healthcare systems and likely to be the slowest to begin to report accurate assessments of an outbreak. Structuring the pandemic bond, as Euromoney reported in depth at the time, was immensely complicated, not least because it needed to strike a balance between being useful and being investible. The bond will mature on July 15, although it can be extended by one year.

The World Bank is preparing a second iteration of the scheme, dubbed Pandemic Emergency Facility (PEF) 2.0, which the Bank said last year was to be marketed in May 2020. Some of the triggers depend on cases of disease reported by developing countries – those that fall within the World Bank’s lending categories of IBRD (International Bank for Reconstruction and Development) or IDA (International Development Association).

Among the parameters governing whether or not the bond is triggered, and how much it pays out if it is, are: the number of countries affected; the number of cases in each of those countries; the number of deaths; the percentage of confirmed cases to total cases, including suspected; and the growth rate of cases. All of these will be assessed based on specific reporting periods. The conditions to trigger the bond need to be in place at least 12 weeks after the designated start of the event for payouts to happen. After that, they must be in place on a rolling 12-week basis.

In the event that the bond is triggered, it will release funding only to IDA countries. A country seeking assistance is required to request the funds, although requests can also be made by certain designated responding agencies, chiefly multilateral development banks and United Nations agencies.

yogaesoteric

March 30, 2020