Did the Bilderberg Group orchestrate the 1973 oil crisis?

In 1973 the Bilderberg Group discussed the shift that was underway in the political, economic, strategic and power relationships between the oil-producing countries, the consumer countries and international oil companies.

Five months later, the Arab oil embargo was announced throwing the world’s economy into the steepest economic contraction since the Great Depression.

Various commentators have suggested that this may not have been a coincidence and that the Bilderberg Group had orchestrated the 1973 oil crisis.

In 2001, the former Minister of Petroleum and Mineral Resources of the Kingdom of Saudi Arabia, Sheikh Zaki Yamani, said he “is 100% sure that the Americans were behind the increase in the price of oil” back in 1973 and 1974. He adds that “they had borrowed a lot of money and they needed a high oil price to save them.”

Yamani contended that proof of his long-held belief was in the minutes of a secret meeting on a Swedish island, where UK and US officials determined to orchestrate a 400 per cent increase in the oil price.

Below, after giving a brief description of the 1973 Arab oil embargo and related events, you can read extracts from the 1973 Bilderberg meeting Conference Report, which we assume to be the same as what Yamani described as “minutes of a secret meeting.”

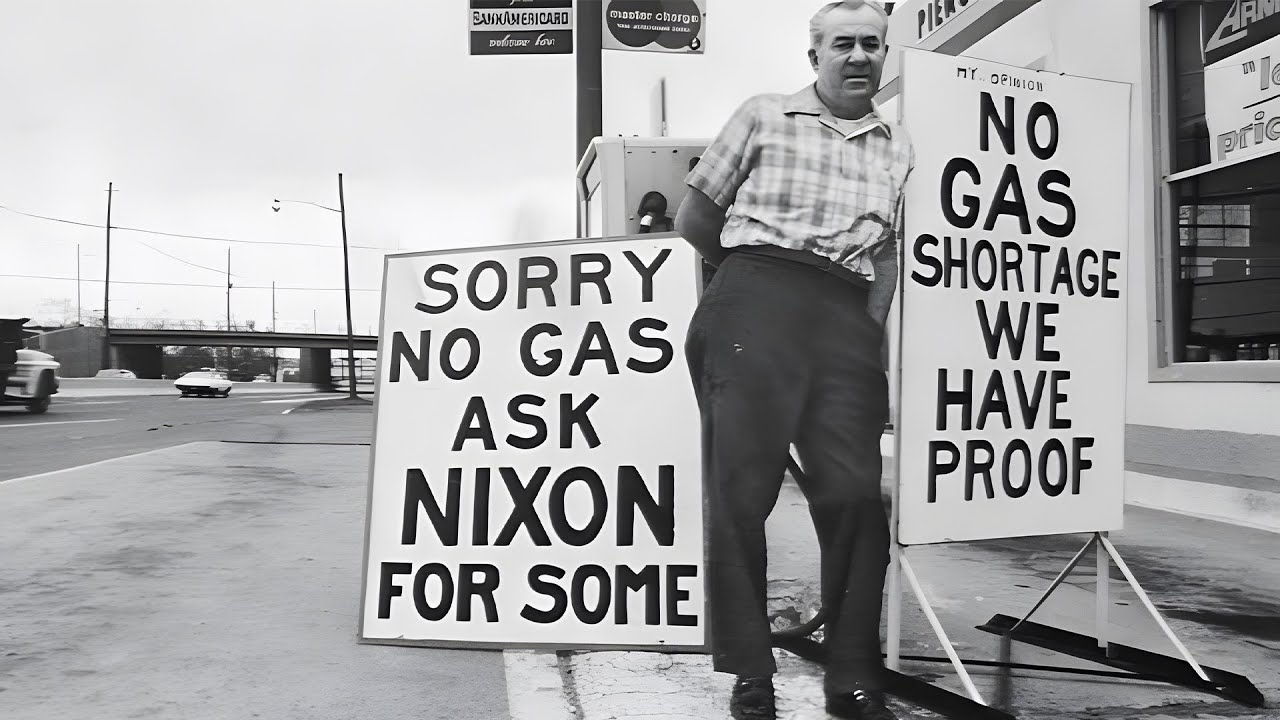

1973 Arab Oil Embargo

The 1973 oil crisis was caused by an embargo by Arab oil-producing nations in response to US support for Israel during the Yom Kippur War. The Organisation of the Petroleum Exporting Countries (“OPEC”) approved the embargo on 19 October 1973.

OPEC demanded that foreign oil corporations increase prices and cede greater shares of revenue to their local subsidiaries, leading to a temporary cessation of oil shipments from the Middle East to the United States, the Netherlands, Portugal, Rhodesia, and South Africa.

The OPEC oil embargo quadrupled the price of oil in six months. Prices remained high even after the embargo ended.

The 1973 energy crisis and inflation that followed were caused by several factors, not just US support for Israel. There had been a decades-long struggle between the governments of oil-producing nations and the large US oil conglomerates for control over the global oil market.

Until the 1970s, OPEC, formed in 1960, had kept a relatively low profile, mainly negotiating with international oil companies for better terms for its member countries. OPEC saw the Yom Kippur War as a way to make its geopolitical power known and to strike a blow at the US oil giants.

The embargo caused the United States and Western European countries to reassess their dependence upon Middle Eastern oil and led to far-reaching changes in domestic energy policy, including increased domestic oil production in the United States and a greater emphasis on improving energy efficiency. In his book, Confessions of an Economic Hitman, John Perkins mentioned the aftereffects of the embargo:

“The embargo also resulted in significant attitude and policy changes. It convinced Wall Street and Washington that such an embargo could never again be tolerated. Protecting our oil supplies had always been a priority’; after 1973, it became an obsession. The embargo elevated Saudi Arabia’s status as a player in world politics and forced Washington to recognise the kingdom’s strategic importance to our own economy.

There seemed little doubt that the 1973 oil embargo – which had initially appeared to be so bad – would end up offering many unexpected gifts to the engineering and construction business, and would help to further pave the road to a global empire.”

In 1979, the United States and Saudi Arabia negotiated the United States-Saudi Arabian Joint Commission on Economic Cooperation. They agreed to use US dollars for oil contracts. The US dollars would be recycled back to America through contracts with US companies. The Balance of Money noted that these companies would then improve Saudi infrastructure through technology transfer.

Bretton Woods International Monetary System

At the same time as the Arab oil embargo, the world economy was in recession, and the Bretton Woods international monetary system was formally ended in 1973.

The Bretton Woods international monetary system was established by delegates from 44 nations in July 1944 at the United Nations Monetary and Financial Conference in Bretton Woods, New Hampshire. It established a system of fixed currency exchange rate using gold as the universal standard.

The agreement also facilitated the creation of the International Monetary Fund (“IMF”) and the International Bank for Reconstruction and Development (“IBRD”), which is known today as the World Bank.

Backing currency by the gold standard started to become a serious problem throughout the late 1960s. By 1971, the issue was so bad that US President Richard Nixon gave notification that the ability to convert the dollar to gold was being suspended “temporarily.” The move was inevitably the final straw for the system and the agreement that outlined it.

There were several attempts by representatives, financial leaders, and governmental bodies to revive the system and keep the currency exchange rate fixed. However, by 1973, nearly all major currencies had begun to float relatively toward one another, and the entire system eventually collapsed.

Because Bretton Woods and the fixed dollar went up in smoke, Lew Rockwell wrote, the IMF’s reason for existence evaporated. The big banks such as Chase Manhattan, Citicorp and the Bank of America took advantage of the situation and used the IMF, which was looking for something to justify its existence, to solve their problems.

1973 Bilderberg Meeting

The 1973 oil crisis and subsequent events were discussed with surprising accuracy five months earlier at a Bilderberg meeting. The website Public Intelligence has a copy of the Conference Report from the twenty-second Bilderberg meeting held in Saltsjiibaden, Sweden, from 11 to 13 May 1973.

Under the chairmanship of H.R.H. The Prince of the Netherlands, there were 80 participants, drawn from a variety of fields: government and politics, universities, journalism, diplomacy, industry, transport, trade unions, the law, banking, foundation administration and military service. They came from thirteen Western European countries, the United States, Canada and various international organisations.

Among the participants were Gerrit Wagner, the CEO of Shell, and of the other oil majors: British Petroleum (BP), Total S.A., ENI, Exxon.

The first item on the agenda was to discuss two working papers that examined the guidelines of a common energy policy for the European Community and consider how the main energy-consuming countries might cooperate with one another. In the Conference Report, the two papers were titled Guidelines for A European Energy Policy and Its Consequences on Relations Between Europe and North America and An Atlantic-Japanese Energy Policy. Below, we refer to these as Paper 1 and Paper 2 respectively.

The Papers

Paper 1’s author described why there was a fresh impetus for the European Community (“EC”) to have an energy policy: “The European Community, heavily dependent on the outside world for its energy supplies. The Commission’s main present concern – as its latest proposals showed – was the question of supplies.” The author then discussed suggestions to overcome energy supply problems and the mapping out of an energy policy.

The final section of his paper discussed the need for cooperation between the EC, USA and Japan:

“Chief among [the reasons for cooperation] was the fact that the [European] Community, the US and Japan were all dependent, at least in the medium term, on other countries for their energy supplies, with all the economic, political and security problems that this implied.” [pg.17]

“The European Community had already made it known unofficially that it favoured energy cooperation with the US and Japan, primarily to eliminate futile outbidding between the importer countries for supplies, especially from the Middle East.” [pg.17]

“Finally, energy cooperation should fit into a context of more general consultations covering monetary matters, world trade and certain aspects of foreign policy. These general consultations between the Community, the US and Japan were an ambitious undertaking, in which energy consultations – because of their urgency and the apparent widespread agreement thereon – could constitute one of the cornerstones.” [pg.21]

“The experience of the OECD should make it a useful forum in which to begin this Atlantic-Japanese collaboration, although its procedures might have to be revised.” [pg. 22]

While the author of Paper 1 was described as an “International author,” the author of Paper 2 was named as an American. The report from the 1973 meeting summarised his paper as follows:

“An Atlantic-Japanese Energy Policy

Summary

The conclusions of the American author of this working paper could be summed up as follows:

The prosperity and security of the Free World depended on sufficient availability of energy on satisfactory economic terms. During the next ten to 20 years, oil would provide the mainstay of the world’s energy supplies. Because of the size of known reserves and the lead time for developing new resources, our growing needs would be supplied mainly by huge increases of imports from the Middle East.

The cost of these oil imports would rise tremendously, with difficult implications for the balance of payments of consuming countries. Serious problems would be caused by unprecedented foreign exchange accumulations of countries such as Saudi Arabia and Abu Dhabi.

A complete change was underway in the political, economic, strategic and power relationships between the oil-producing, importing and home countries of international oil companies and the national oil companies of producing and importing countries.

An energy policy for the oil-importing countries was an urgent necessity. It could not be limited to the Atlantic nations, but had to include Japan, the Free World’s second strongest economic power and one of its largest oil importers. It should also encompass South Africa, Australia and New Zealand, and should take account of importing developing countries in Latin America, Africa and Asia. But the suggestions in his paper would refer mainly to the Atlantic group plus Japan as the nations with major world influence and responsibilities.”

Paper 2’s author noted that by 1980, for the first time “the US would be competing with Europe and Japan for major oil supplies from the Middle East. The USSR was likely to remain self-sufficient in oil and other energy requirements and might continue to be a net exporter of oil and natural gas.” He added:

“The US thus had to share with Europe and Japan the deep concern about the physical availability, the terms of trade, the balance of payments impact, and the investment and monetary consequences of heavily increased oil imports. But the US carried the additional responsibility of protecting its capability to perform its global defence commitment, especially since the Soviet Union and China did not primarily depend on external sources of energy. The US could not afford an increasing over-dependence on a handful of foreign, largely unstable, countries. This would jeopardise its security (and that of its allies) as well as its prosperity and freedom of action in foreign policy formulation.”

The author described the changes in power structure which included the rise of the Organisation of the Petroleum Exporting Countries (“OPEC”) between 1960 and 1972 and the decline of the relative power of the US. “During the same period, American reserve productive potential had begun to disappear, and by 1972 the US had become one of the largest importers of oil,” he said.

“The conclusion of the participation negotiations had left little doubt that the major oil-producing countries [in the Middle East] had acquired immense potential power. The power of these countries was based not only on their control over immense oil resources, but also on their prospective command of unprecedented financial resources. Moreover, large monetary reserves would enable them to restrict oil production for political or other reasons.” [pg. 25]

“Not the least of the dangers posed by this concentration of oil power and ‘unearned’ money power was the pervasive corruptive influence it might have on political, economic and commercial behaviour in both the relatively unsophisticated societies of the producing countries and in the dependent industrialised nations. Lust for immense power and greed for money in unheard of amounts could easily corrode part of their – as well as our – political and social structure.” [pg. 27]

The Discussion

After the authors had introduced their papers to the Bilderberg meeting, there was a discussion. The text of the discussions begins on page 35 of the Conference Report. Below we highlight some of the points made which gives a feel for the global power and influence that both oil and the Bilderbergers wield, and, perhaps, evidence that the Bilderberg Group did orchestrate the 1973 oil crisis. We have noted the page numbers of the report in square brackets at the end of the paragraph so our readers can more easily find the quoted text to put it into context.

Nature And Scale of The Energy Problem

According to the author of the American working paper, the “energy problem” was compounded of four principal issues: the continued requests for price increases from Middle East producing countries; the threat to the availability of supplies; the use of oil for political purposes; and, the attack against the oil companies’ ownership position.

“The continued requests for price increases from Middle East producing countries, accelerated by the devaluation of the dollar. The international oil companies might wage a rear-guard action, but in the end they would yield rather than risk interruption of supplies. They believed it was up to the economies of the consuming countries to absorb these price increases.” [pg. 35]

“These various issues added up to a political crisis, not an oil crisis, in the view of a British participant. With a rising value to their asset, it was in their interest to leave it in the ground, regardless of world shortages. Producing countries would thus be able to determine the standard of living of consuming countries, and to enforce their political will upon them.” [pg. 36]

“Libya’s price demands, which had been made just as this meeting convened, happened to furnish an excellent illustration of the sort of problem faced by the oil companies. That country was responsible for one-sixth of Europe’s oil supplies, so that one’s access to a daily hot bath depended very much on the attitude of Colonel Qadhafi, as the British speaker put it.” [pg. 36]

“With reference to the question raised by a French participant about the possibility of important new oil discoveries, the American speaker conceded that there were indeed vast reserves of hydrocarbons, but they were clearly finite. Although many parts of the world had not been actively explored, geologists had a pretty good idea of what could be found. It was unlikely that this trend would be reversed, and within five to ten years we might in fact be consuming hydrocarbons at a rate 50 per cent greater than the rate of new discoveries.” [pg. 37]

What Can Be Done About the Supply Situation?

“It was generally agreed that we would be dependent on Middle East oil for at least the next decade.” [pg. 37]

“According to an American participant, any analysis had to begin with a recognition of the predominant role to be played by Saudi Arabia. The security and prosperity of all of our countries thus depended ‘on how King Feisal feels’, in the words of another US speaker.” [pg. 37]

“A Canadian participant said that, although Saudi Arabia appeared now to be a country with whom arrangements could be made, experience in the Middle East had shown that regimes which were seemingly solid and in control of the domestic political situation could be replaced overnight. There was not only the Soviet interest in upsetting regimes around the Persian Gulf, as part of their long-term aim of controlling the Middle East, but there were also contests among the Arab states themselves. The one issue which appeared to unite them was the conflict with Israel, which posed serious political questions for the US and others in the bargaining for oil.” [pg. 38]

“A British speaker agreed that settlement of the Arab-Israeli dispute was essential to progress in the Middle East. He had been struck, during recent trips to that part of the world, by evidence that the Arabs were deliberately trying to drive a wedge between Europe and America.” [pg. 38]

“Another American participant referred to the interrelationship between Soviet policy and the Arab-Israeli conflict. The Soviet objective was a prolonged stalemate, which would intensify the process of Arab radicalisation, stimulate stronger feelings of anti-Westernism, and in turn provoke Western animus toward the Arabs. Hence the Western response ought to focus much more directly on the need to promote actively an Arab-Israeli settlement.” [pg. 39]

“The impact of a possible change in Soviet policy on the question of the Middle East oil supply was discussed by an American participant. Since, as the author of the American working paper had pointed out, it was an asset for us that Saudi Arabia depended on the US for its security, then a mood of détente could produce an inauspicious effect if the USSR were no longer to be regarded as our eternal adversary in the Middle East. On the other hand, the more dependent the Soviets became on economic dealings with the West, the less satisfaction they would derive from the prospect of uncertain Western oil supplies. Thus, before the end of the seventies, we might be consulting with the Soviet Union about Middle Eastern oil.” [pg. 39]

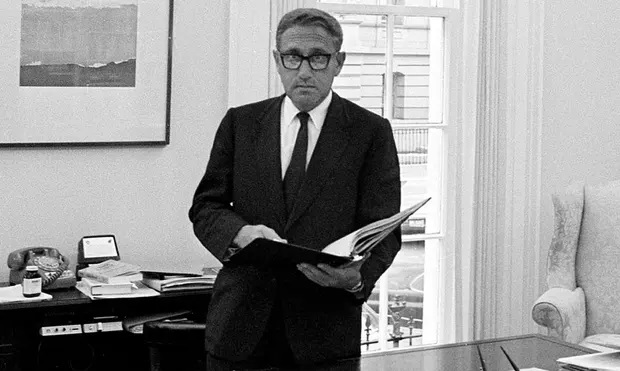

Note: Following years of growing strains between the United States and the Soviet Union, the two superpowers engaged in an era of détente diplomacy from 1969-1979. Détente, French for “relaxation,” is “a process of managing relations with a potentially hostile country in order to preserve peace while maintaining our vital interests,” Henry Kissinger, then U.S. secretary of state, told a Congressional committee in 1974, while warning that such a relationship faces “sharp limits.”

Negotiations With the Producing Countries

A British speaker said that “the producing countries had two ways of applying pressure: first, by singling out a particular country with whom they were displeased at the moment (e.g., the US over its Israel policy); and second, by picking off one or more of the international oil companies, from whom they thought they could extract higher prices. Defending this double front was not easy. Formal international agreements would probably take years, not months, to work out. To solve the immediate, short-term problem, the speaker proposed the urgent establishment of an interim ‘action committee’ to formulate a joint answer ‘to attempts by producing countries to turn the heat on’.” [pg. 41]

“[An] American asked what good unity and firmness would do in the face of a decision by producing countries to keep their oil in the ground, and a Norwegian participant was not sure what cards the Western governments could play to exert more pressure on the producing countries, if we resorted to sovereign-to-sovereign negotiations.” [pg. 42]

“A British participant wondered whether a sovereign-to-sovereign confrontation was necessarily the best answer. General Gowan had already said privately, for example, that if Britain should adopt a Rhodesian solution which he could not support as an ardent African nationalist, he would be quite prepared to ‘punish’ her by a temporary boycott of Nigerian oil shipments.” [pg. 43]

“According to another British speaker, during the next 10 to 15 years the problem would be not so much the physical availability of oil in the world as the fact that supplies were concentrated in the hands of countries which were exploiting the situation for purely economic reasons.” [pg. 43]

Transforming “Our” Relations with the Arab States

“Several speakers expressed the view that negotiations with the producing countries would be more fruitful if their context were broadened beyond the confines of the oil supply question.” [pg. 44]

A Netherlands participant said “it was foolish to advocate political or military interventions. We needed instead to offer [Arab countries] the prestige of being accepted and involved in our councils of trade and monetary matters.” [pg. 45]

“An Italian participant said that errors in economic and political forecasting had brought us to our present position of absolute dependence on the Middle Eastern countries for our oil supplies. Their requested price increases were simply a reflection of the law of supply and demand which we had always espoused. If we believed that better relations with the Arabs were needed to secure our needs, we had to be prepared to offer them ‘something more than a common merchandise agreement’.” [pg. 45]

“A Netherlands participant thought that our relations with the Arabs would be much improved if we were to meet with them more regularly, and not just in the urgency of a crisis, when conflicting emotions were bound to be dominant. He suggested therefore that it might be useful to form an unofficial ‘working committee’, composed of delegates from the producing countries, the oil companies, the OECD and public representatives.” [pg. 45]

Sharing the Available Supplies

“A US speaker said that the struggle for shares of available oil supplies would impose unprecedented strains on the world. If it became an issue between the US and Europe, ‘it would be the greatest single threat to the solidarity of the Atlantic community that we’ve ever seen’.” [pg. 46]

“Another American participant remarked: In dealing with this crisis, it would be impossible for the oil companies to take it upon themselves to allocate available supplies among the various consuming countries. This job had to be done by the governments, who therefore ought to reconstitute and modernise the old OECD emergency plan as soon as possible.” [pg. 46]

A Netherlands speaker remarked that “to permit the necessary cooperation by the oil companies, there would have to be a specific, formal relaxation of the US anti-trust laws.” [pg. 47]

“A general description of the activities of the OECD in the energy field was provided by an International participant. The speaker was confident that appropriate ways would be found within the OECD to associate the efforts of governments and the petroleum companies in meeting their responsibilities in this field.” [pg. 47]

“The British participant who had proposed the creation of an ‘action committee’ said that he would not exclude the possibility that the OECD Oil Committee could form the basis for such a body, but it would have to be thoroughly reorganised to enable it to take the kind of direct action in dealing with producing countries that he thought of.” [pg. 48]

Alternative Sources and Forms of Energy

“A French participant wondered if cooperative development of the Soviet Union’s oil and gas reserves would not serve the double purpose of reducing our dependence on the Middle East and improving East-West relations.” [pg. 48]

“An American participant described the proposed US-Soviet natural gas deal as ‘most extraordinary’. In essence, the Russians were hampered in developing their Siberian resources by both technological and budgetary constraints. They had therefore asked the US to finance this development (which would take five to eight years), in exchange for which they would sell the gas to American consumers at four times the price they were now paying. During a subsequent eight-year period, the Russians would reimburse the US development loan, after which there was a vague commitment by the US to continue to buy gas in return for the Soviet’s earmarking those revenues to purchase American goods. In short, the US payments deficit would be increased to allow the USSR to maintain its military budget. The only possible justification of this deal was that of political advantage, which was used ‘to cover all kinds of crimes’. Another American speaker thought it extremely doubtful that the US-Soviet gas deal would ever go through.” [pg. 48]

“In the opinion of a French speaker, we had lost sight of a fundamental economic rule: energy, like any commodity, had its price. For too long, Europe and America had consumed cheap fuel without setting aside financial reserves for its replacement or substitution. We had now belatedly to recognise that prices needed to be high enough to meet the demands of the producing countries as well as to cover the costs of research and development for new fuel sources, notably atomic energy.” [pg. 49]

“A Norwegian speaker thought that the long-term aspects of the proposals were even more important than those relating to the next decade, for Europe as well as the US, as ‘the hydrocarbon as a source of energy is historically going to be an episode, and not an epoch.’ By the year 2000, hydrocarbons would be used chiefly as a raw material and for certain forms of transport. Conventional energy would be solar, geothermal, nuclear and coal-based.” [pg. 51]

“Although he thought it unlikely that the Arabs would not increase their oil production during the next several years, an American participant said that ‘something other than hydrocarbons is absolutely essential for the longer run’.” [pg. 51]

A Canadian speaker said that “nuclear energy offered the best early opportunity to replace petroleum for the static generation of energy, i.e., for non-transportation uses.” [pg. 52]

“According to a French participant, Europe had nearly reached its limit in hydroelectric production, coal was uneconomic, and solar energy lay too far in the future. Nuclear energy gave the only promise of reducing our dependence on petroleum.” [pg. 53]

“A British speaker, conceding that we would be greatly dependent on nuclear energy a decade from now, wondered if we could calmly accept the risks involved.” [pg. 53]

“A Belgian speaker reminded the meeting that the word ‘nuclear’ still evoked an emotional public reaction. An educational program was needed to reorient our system of values, so that a nuclear reactor was regarded more favourably than a fuel oil plant.” [pg. 55]

What Can Be Done About the Demand Situation?

“A German participant asked whether the energy forecasts on which the discussion had been based were necessarily inexorable. With so many Western countries approaching zero population growth, would consumption indeed continue to grow as predicted? Could not the public be educated as well to renounce certain comforts to which they had become accustomed, such as air conditioning, overheating and the proliferation of private transportation?” [pg. 55]

“A comparison of working conditions today and a generation ago in US factories, mills and offices was offered by an American participant. Much of the improvement in workers’ health and efficiency was attributable to the advent of air conditioning and air cleaning, and American offices and plants now routinely incorporated those features. Another, less desirable, development during recent years had been the steady decline in the reliability of commuter railroad service, which had brought many Americans to rely increasingly on their automobiles to get to and from work.” [pg. 56]

“Several participants referred to the particularly depressive effect which a reduction in energy consumption would have on the vulnerable less-developed countries, who were just now poised to make new advances on the social and economic scale. The consensus was that special preferential arrangements were warranted to guarantee the ‘third world’ import and consumption levels sufficient to sustain its momentum toward development. A British speaker pointed out, however, that 92 per cent of the automobiles in the world were located in North America, Japan and Europe.” [pg.56]

“An American participant felt that reduction of demand in his country would be aided by a new energy crisis statement from the administration, suggesting specific consumer actions and attitudes that would cut consumption. A change of orientation in advertising by the energy industry in general would also be helpful. Another US speaker said that the energy crisis was so far too abstract and potential for the public to grasp, and a Netherlands intervention suggested that many industrial leaders as well lacked a sense of urgency about the problem.” [pg. 57]

“Many of the participants were convinced that a radical change in our modes of transportation was the key to a substantial reduction in energy demand.” [pg. 58]

“A Belgian intervention emphasised the need for a ‘psycho-social and political’ reorientation of our values, to enable an efficient network of public transport to replace our ‘absurd system’ of urban transportation by private automobiles, with its attendant problems of parking, road congestion and air pollution. Although this reorientation would not completely solve the energy problem, even a marginal reduction in demand would be welcome in the supply crisis which lay ahead.” [pg. 58]

“An American speaker, responding to a British question, feared nevertheless that gasoline shortages and rationing could cause unemployment and ‘tremendous social disruption’ in the US automobile industry. A German participant was inclined to share that concern. He foresaw ‘enormous consequences’ for the automobile industry and for our economies as a whole if oil became much more expensive or was in really short supply.” [pg. 59]

“Opinions were divided about the effectiveness of tax incentives or disincentives.” [pg. 60]

“A Belgian participant explained that, in the past, European countries had generally not practised ‘fiscal neutrality’ in the energy field: the oil sector had been taxed more heavily than coal or nuclear energy. Although this policy had admittedly been discriminatory, it had perhaps been right; otherwise the demand for oil products today would be even greater.” [pg. 60]

“A British participant, agreeing that heavier taxes on oil itself would subject us to more OPEC pressure, proposed instead that taxes be increased on those automobiles and machines which consumed oil extravagantly. ‘Nothing would do more to promote the use of small cars; this would not be rationing by the purse, it would be exactly the opposite. We would discourage better-off people from having bigger cars’. He also advocated fiscal means to discourage the use of private motor cars for city commuting, thereby aiding the development of mass transit systems which would use one-fifth or one-tenth of the energy. A US participant intervened to remark that this speaker had ‘developed a new devil: the American consumer, particularly the automobile driver’.” [pg. 60]

“A Netherlands participant reported that the attempts in his country to replace the motor car with public transport by means of price policy had failed. In the long run, the only way to be sure of checking the use of automobiles – which was essential – was by physical restrictions on the roads and parking facilities.” [pg. 61]

“The potential impact of oil developments on the world monetary system was dramatically indicated by an American participant, who said that before the end of the century some 350 billion barrels of oil would be produced in the relatively small geographical area at the headwaters of the Persian Gulf. This production would be worth from one to more than three trillion dollars, according to the price per barrel.” [pg. 64]

“An International participant mentioned that representatives of the OPEC countries were involved in the discussions of the Committee of Twenty for the reform of the monetary system. They were ‘talking sensible, businesslike language’ in requesting a stable system which would enable them to invest their oil revenues. These remarks were seconded by an Italian speaker, who added that early reform of the monetary system was essential to solve the liquidity problem and to encourage the OPEC countries to make longer-term investments.” [pg. 64]

“In the judgment of a Dutch commentator, the build-up of ‘hot money’ in the Eurodollar market was making it increasingly difficult to create an efficient monetary system. So far, though, the oil money did not seem to be an especially aggravating factor.” [pg. 64]

“A British participant said that our work in reforming the international monetary system should not be dominated by the oil issue. Conceivably, though, the Arab countries would benefit indirectly from whatever solution the Committee of Twenty might find to the problem of international reserves.” [pg. 65]

“As big as the monetary impact of the oil situation might become in the future, it would be ‘only a little addition – not much more than a tenth – to the deep mess which we are in already’, according to a German speaker. ‘We have first to solve the basic mess and then see to the oil problem, and not in the other order’. Unless confidence in the dollar returned, world monetary reform would be just ‘an abstract academic exercise’. America’s friends would help her, but first she had to set her strategy. Eventually we should work toward an international federal reserve system which could impose rules on foreign currency accounts. If the Euro-markets had been subject to regulation in the way that national banking systems were, things would not have gotten out of hand as they had done. It was important to recognise that the oil money question was merely a part of this much larger framework.” [pg. 65 and 66]

yogaesoteric

October 13, 2023