The US Economic Warfare (I)

The United States became a militarized state, a perpetual war machine, fundamentally oriented towards the domination of the other states, at all levels. As shown in previous works, this status is viewed in the theories of political realism, as an expression of any superpower’s tendency to achieve hegemony, thus ensuring its maximum degree of security. In terms of political realism, the Power of a state is chiefly conferred by the state’s military force. The higher the force of the army, the greater is the persuasion of that state on the others. Ultimately, “the law of force” is the strongest argument. It is useful to recall that political realism explains more precisely that the power of a state is its ability to convert latent resources (socio-economic components) into effective power (military power).

Following the logic of this power equation, we understand why the United States is obstinately seeking to control as many global resources and markets as possible and makes huge investments to deploy an army to dominate the entire planet. So in order to ground the Power, to feed the war machine, resources are needed. Resources became a strategic objective and for this reason the White House officially announced its determination, assuming that “uninhibited access to key markets, energy supply and strategic resources” is represents a “vital national interest for US” for which it is determined to resort even to “unilateral use of military power.”

Nevertheless, market control means much more than access to resources. It means controlling the global economic and financial system as well. A decisive step in this direction was made after the Second World War, with the establishment of a strong network of global institutions. Beyond the pacifist and altruistic ideals expressed, these institutions are built in such a way as to ensure a substantial advantage for the US economic system. The US dollar is the reference currency for global foreign exchange reserves, based on which most trade are conducted and to which the World Bank (WB), the International Monetary Fund (IMF) or the World Trade Organization (WTO) relate. The petrodollar system, which continually favors, implicitly, the demand for US dollars in the global market, is, we could say, the very structural axis of US economical domination. I presented many examples that pointed out the aggressiveness with which US administrations require the petrodollar system keeping, any offense in this respect being severely punished at a political, economic or even military level.

The Mechanism of State Indebtedness

The dollar is a banknote issued by the Federal Reserve Bank (FED), a private cartel that has the authority to issue currency by law. An essential aspect I referred to as well is that since 1971, the US currency is no longer gold-backed. On the 15th August 1971, US President Richard M. Nixon shocked the global market when officially put an end to the international convertibility of US dollars in gold, thus bringing the end of the Bretton Woods agreement. From that moment on, the American dollar became a “fiat currency,” an abstract entity that is no longer supported by any physical commodity.

By nullifying the equivalence of dollars with gold, Washington affected not only US economic policy but also global economic policy. In the Bretton Woods system, all currencies related their value according to American dollar. And the dollar derived its value from the established fixed price of gold reserves. But when the value of the dollar was detached from gold, it became what economists call floating currency. The term floating means that the currency is not attached, it is not related to a physical, external value. The most frequently used term for this is fiat money. Obviously, since the dollar became a floating currency, the rest of previously dollar- equivalated currencies became floating too (i.e. fiat currency).

Through globally issuing a currency that has no use value and for which it levied particular taxes, the Federal Reserve Bank developed a strong interest in keeping a global, stable and growing demand for US dollars. And indeed, the domination power of the US dollar steadily increased, and the other states of the world have contributed inevitably to this process, which in fact creates a detrimental addiction. And if any state gets into economic trouble, the cartel of global financial institutions proposes a seductive solution: a loan. But the influx of dollars will add a little improvement only in the short term. Long-term dependence on the dollar is accentuated as loans are almost impossible to repay. Through this genuine trap the states enter a spiral of debt that dizzyingly grows with every year, which makes them much easier to sway at a political level. Here is in short how the world’s states progressively become, through this system, in the position of vassal states to the international financial system.

Naturally, in time the situation generated from the states that were deluded a series of initiatives to shift to other reference currencies. But these attempts were promptly and severely punished. Under various pretexts, those countries were attacked economically, and even militarily by NATO (led by the US), and often the leaders of those states were assassinated and replaced by others, more… cooperative.

At this point it becomes necessary to foreground one important matter: the financial system that controls the world does not serve the United States as a nation, but only the international financial Elite, which established global control centers in America and which avails the Washington administration. We may observe in this sense that although the financial elite accumulated tremendous riches, the American people themselves are brought to their knees and dominated by financial manipulation. Without going into too much detail, I mention that US dollars are emitted by the private institution Federal Reserve Bank as a loan to the United States government, under the title “Notes of the Federal Reserve.” For this loan, the Federal Reserve charges interest too, the rate of which is also fixed by FED. Obviously, the higher the “borrowed” amounts, the higher the interest. This is one of the reasons (very little brought into public attention) that explain why the United States began accumulating colossal debts for decades.

Understanding very well that this financial system enslaves and destroys the American economy, President J.F. Kennedy issued an executive order (order No 11110) on June 4, 1963, withdrawing FED the authorization to print banknotes and transferred this function to the US Treasury, which he empowered to print dollars with the title “United States Notes.” He was aiming in this way to stop the fraud by which the Federal Reserve extorted the American people with fake money for which it also charged interest. In his economic report presented before the Congress, Kennedy said: “I urge the Congress to take prompt action and repeal of the (…) authorization for the Federal Reserve System to issue notes.” As we know, a few months after he signed this order, in November 1963, J.F. Kennedy was assassinated.

It is notable that in 2008, when the economic crisis hit the entire American financial system (with global repercussions), the US government introduced atypical tax policies (such as bail out, quantitative easing or negative interest) which had the purpose of preferentially injecting money into sectors deemed “too big to fail” (especially banks). As Steve Bannon, former chief executive of Donald Trump’s presidential campaign explained, to save globalist’s business in the US, the Wall Street’s elites opened the liquidity taps and printed (from nothing) no less than 4,000 billion dollars. The entire burden of the crisis has been loaded by the middle class and low income taxpayers, who ruined their already difficult financial situation and eventually deepened even more the gap between the rich and the poor.

Currently, amid the enormous military spending and the gradual devaluation of the dollar, there is a worsening of the US fiscal situation. The federal government reached a annual budget deficit of $ 1.1 trillion in 2019, which is huge. More specifically, the US has $ 3.7 trillion in revenue and $ 4.8 trillion in spending. Much of the expenditure is made up by the military budget, which is $700 billion a year. Considering the budget deficit, it means that the US economy goes on the whole at a loss. US debt reached astronomical value: over $22,4 trillion in July 2019. It is the largest in the world! But did you wonder who does America owe this money to? Well, the answer is telling: first of all to the financial institutions that “lent” its money, of course! In conclusion, it had already become a sort of ’public secret’ that Washington administration, along with the US Congress is dependent on the Federal Reserve, an institution which they cannot really regulate.

Regarding foreign economic policy, it has become more and more common in recent years that the US administration (which bends to certain influences) sanctions, obstructs and blocks through overwhelming American currency market domination, any state that does not obey the White House directives. Among the intensely sanctioned states in the current period one may list Russia, China, Iran, Turkey or Venezuela. Far from being simple “fines,” the sanctions can have particularly severe impact on the targeted country’s economy because it involves blocking sales / buying transactions on the global market and many other particularly inconvenient restrictions. And what’s the worst is that sanctions get to kill people. Western corporatist media avoids this aspect of reality, and prefers to intimate that sanctions are a kind of gentle cautionary measures. Measures that only hinder economy and create a negative image to “corrupt” or “dictatorial” elites of the targeted state. In reality, sanctions primarily affect the population because they restrict access to drinking water, food, and medicines. In order to get a picture of the disastrous effect that the blockade of sanctions can bring, I recall that following the embargo on Iraq (through the United States initiative), between 1990 and 2003, 1.5 million Iraqis died, out of whom, more than half a million children.

To put it plainly, sanctions became a routine, an economic weapon by which Washington’s neocons seek to get to despair a nation, stir a revolt, and then intervene militarily for ’humanitarian reasons’ to save the population, and to establish ’democracy’.

It is relevant to make a brief overview with concrete data. As reported by the US Department of the Treasury, President Obama signed a hundred sanctions during the ten years he spent at the White House. Yet, Trump has already outnumbered him after only two years in office, approving a few hundred sanctions. Here is a part of them.

The most destructive infliction of sanctions takes place in Iran, against which Trump nullified a major economic treaty and introduced 143 sanctions that drastically weakened the Iranian economy. In Syria, Trump authorized 287 sanctions against the Bashar al-Assad regime, almost double the number of sanctions Obama imposed.

In North Korea there were 80 sanctions, in Libya 43.

For the Russian Federation, Trump ordered 105 new sanctions for various reasons, ranging from the annexation of Crimea and the alleged interference in the 2016 elections to the so-called poisoning attempt of the spy Sergei Skripal. Plus other 40 sanctions that relate to cyber-attacks.

In Venezuela, sanctions imposed by the US have a devastating effect. Despite the fact that the country was already severely affected by Obama’s sanctions, Trump added 63 new sanctions, which virtually nullify Maduro’s government’s chance to reinvigorate the economy.

Above all, America threatens that any country that has the courage to establish trade relations with “blacklist” states will also be sanctioned on the charge of undermining international order.

Let’s see some details that will integrate certain important economic and political aspects.

Challenging Russia

The sanctions imposed by Washington began in March 2014, after the Russian Federation’s annexation of Crimea. I have extensively described this context previously, but it is worth noting now, comparatively, that Israel’s annexation of Golan Heights territory from Syria does not prompt any sanctions at international level, although the US-Israel alliance was widely criticized by both the UN and the EU. There is also a crucial difference: Golan was annexed by force, after a war, while Crimea joined Russia through extensive popular adhesion, peacefully following a referendum. And yet, since then, the US (and the EU, under pressure from Washington) consistently places sanctions on Russia for annexing Crimea. It has already become a cliché in NATO rhetoric that the annexation of Crimea is the so-called “clear evidence” of “Russian aggression.”

But sanctions have been imposed on Russia for many other reasons. Because the Russian Federation got involved in the conflict in Syria and would have carried there a brutal air campaign, because it would have been deployed disinformation operations aimed at undermining US and European elections, for Russian military actions in the Donbas region of Eastern Ukraine, or for detaining soldiers from three Ukrainian naval ships in the Kerch Strait on November 25, 2018. Or because it would continue to undermine Western democracies through cyber-attacks and “dark money.”

Sanctions began to manifest their destructive effect as early as 2014. At the end of the year, Russia’s finance Minister announced that punitive measures created an estimated prejudice of $40 billion. On the other hand, Russian President Vladimir Putin warned that the United States is working with Saudi Arabia to deliberately weaken Russia’s economy by lowering the price of oil. According to an assessment made in May 2016, Russia had so far lost about $170 billion due to financial sanctions and nearly $400 billion after losing revenue that could have come from oil and gas transactions.

Russia also reacted by hitting several countries with sanctions, including the total ban on food imports from the EU, the United States, Norway, Canada and Australia. After a period of recession, Russia has, however, begun in recent years to recover and even achieve significant economic progress. In November 2018 Deutsche Welle announced that the International Monetary Fund indicated that the Russian economy went up by 1.7 percent in 2018 and expects to increase by 1.8 percent in 2019. Slow growth, but under drastic sanctions!

What particularly irritates Washington is that Russia continues to sign contracts with countries like Turkey, Syria, India, China or Venezuela to sell units of its S-400 anti-aircraft and anti-missile system, one of the most advanced air defense systems in the world. These contracts are, obviously, the reason for other sanctions inflicted by the White House.

Beyond all this, it seems that, in the end, the effect of the sanctions turns back against those who imposed them. Because precisely the tough policy of punishment determined the great powers of the world to get united against America’s hegemony. To mitigate the effect of sanctions, many states have begun to avoid transactions and possessions in dollars, as they may at any time be blocked by Washington. States form new alliances, focusing on new economic levers, which increasingly set the shift towards a multipolar order.

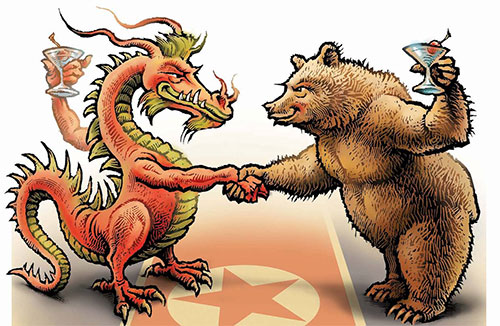

In Russia’s new trade relations the direction of “Moscow-Beijing Axis” is strengthened on the basis of Shanghai Cooperation Organization (SCO), which is a strategic alliance between the People’s Republic of China and the Russian Federation. Another Russia-China cooperation project envisages building a pipeline suggestively called “Power of Siberia,” which will link Beijing directly to the Siberia’s basins rich in hydrocarbons. The project will start for a three decades period and will involve a final investment of $400 billion. Analysts from Bloomberg quote IMF data indicating that Russia’s yuan share was in January 2019 at about a quarter of world’s reserves in yuan to avoid US dollars.

It also visibly strengthens Russia’s relationship with Germany. For many members of the Bundestag, the US demand for Germany to buy US liquefied natural gas (LNG) at a significantly higher price than that of Russian gas appears totally unnatural. In addition, the LNG infrastructure is at an early stage, while the Russian Nord Stream 2 pipeline is almost complete. In fact, in Germany, the suspicion that the US applies sanctions to Russia only as a pretext to actually pursue its own economic interest on the aluminum and natural gas markets has become an ordinary conception. In terms with data provided by Foreign Policy Research Institute, former German Foreign Affairs minister Sigmar Gabriel and Austrian chancellor Christian Kern dared to say it forthrightly: the bill to extend sanctions on Russia is actually targeting the sale of US natural gas!

So we ascertain exactly what the hawks in Washington least wanted: the rise of the Heartland power, the alliance between Russia and Germany, to which China is also associated.

For these reasons, Vladimir Putin stated that America is making a big mistake trying to turn the dollar into an economic weapon. In a speech in October 2018 before representatives of nearly 70 countries at the international forum Russian Energy Week in Moscow, Putin explained that “we aren’t ditching the dollar, the dollar is ditching us” and that “we’re not the only ones doing it, believe me.” In his opinion, “our American partners make a colossal strategic mistake” which he considered “typical of any empire. They think that nothing will happen, everything is so powerful, everything is so strong and stable, there will be no negative consequences. But, no, they come sooner or later.”

(to be continued)

yogaesoteric

March 20, 2020